TL;DR

We’re just coming off the heels of Valentine’s Day and you know how people say love makes the world go round? Yeah, well, fuck that. It’s coffee.

Coffee (the crop from which the drink springs) has not exactly been having a great go of things. In the last decade, it’s received visitations from 3 of the 4 horsemen of the apocalypse – Pestilence, War, and (something close to) Famine – but has managed to persevere. I suspect Death can’t fully kick the habit, so coffee still lives. Even the US walked back its tariffs on coffee. Either way, we’re stuck with the ever-rising bill.

Can you tell the end times have been on my mind a lot?

But so has coffee. I was taken aback by the sheer number of RTD coffee launches from different parts of the world I saw at Gulfood this year. Traditional coffee companies, soft drinks manufacturers, fancy kombucha makers, and even the alt-coffee companies have been expanding into this space.

And with most things that spell change, young people get the blame.

Now, I’m not really in favor of Gen Z scapegoating, but the data doesn’t exactly let them off the hook.

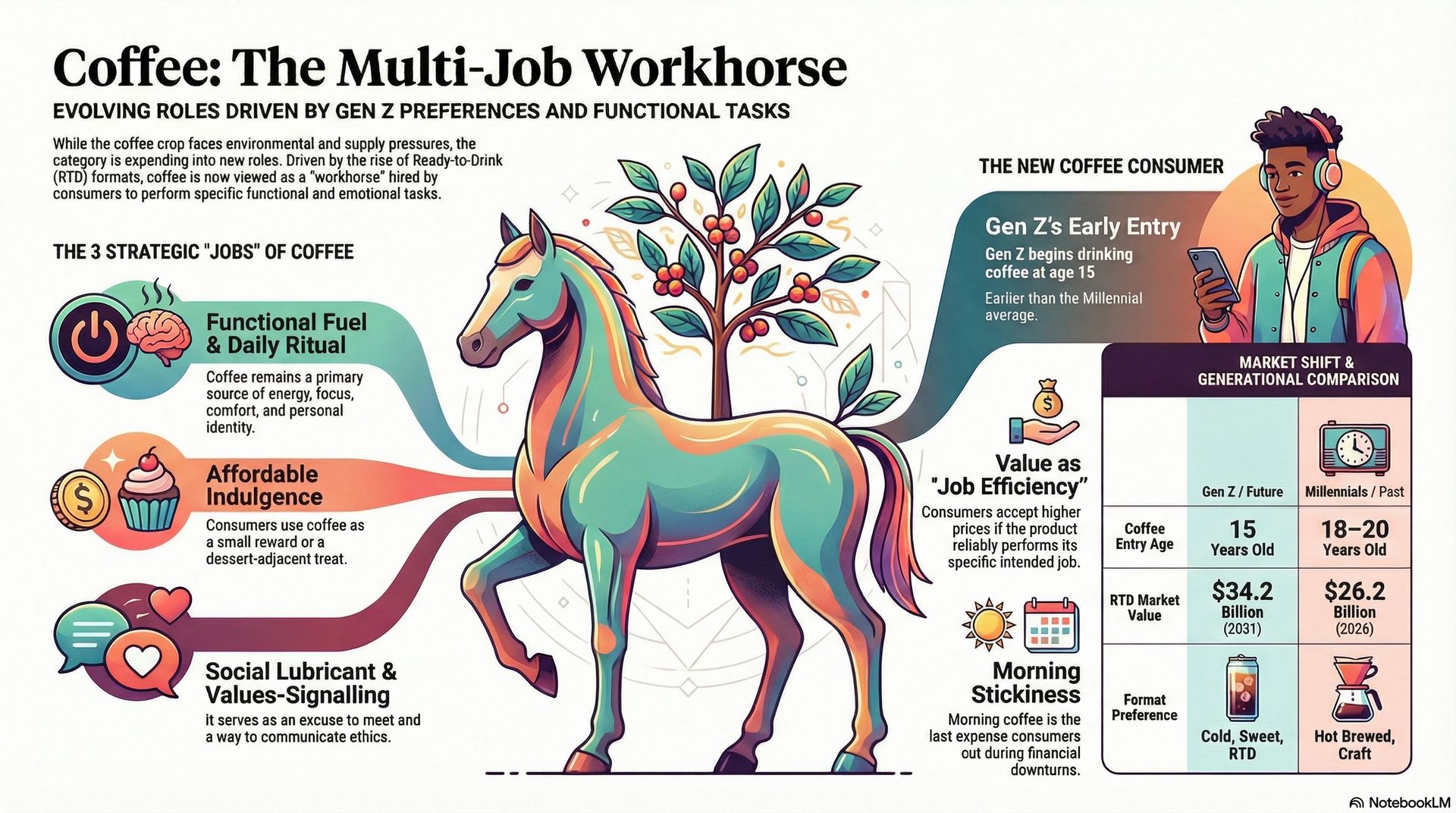

The global RTD coffee market is expected to hit US$26.2 billion in 2026 and grow to US$34.2 billion by 2031.

The World Coffee Portal says that 37% of people under the age of 35 drink iced coffee daily.

Mintel data indicates that Gen Z are “significantly more likely” to drink RTD than traditional hot brewed coffee.

In 2022, the UK had more than 200 RTD coffees on sale, and in 2023, Europe had more than 200 new RTD coffee launches featuring unique flavors and health benefits.

Don’t get me wrong, there was still plenty of the freshly ground coffee knocking about too, but those did seem kind of boring and unapproachable in comparison, with their precious origin and roasting and quality claims, not to mention price tag.

It also got me curious about how coffee was evolving. We had the “waves” format for a while, and I’ve lost track of what wave we’re in now. But I will tell you one thing – the next wave will be all about the different roles that coffee plays in our daily lives. Coffee is increasingly moving from its well-established energy positioning to so many more designations that it’s kind of becoming a multi-job workhorse.

Credit where it’s due: I stole the “coffee is a multi-job workhorse” idea from Darleen Scherer. So I reached out to her to unpack it properly. Darleen is the founder of Black Sheep Coffee Collab, a company that helps build and grow coffee brands.

Darleen Scherer, Founder of Black Sheep Coffee Collab

The 5 jobs of coffee

While coffee will have many more positions, Darleen sees coffee’s job being redistributed across 5 key roles in people’s lives.

It’s functional fuel, because energy and focus still pay the bills.

It’s also a daily ritual, offering comfort, structure, and even identity.

Then there’s affordable indulgence: a small treat or reward. It replaces dessert (and sometimes alcohol), giving you a tiny slice of joy amid the madness.

Coffee still works as a social lubricant, the excuse to meet, linger, or feel part of a place.

And it even lets you do a bit of values-signaling, allowing the transmission of ethics, sustainability, and even taste literacy as a way to communicate who you are.

But these jobs aren’t growing equally. Fuel and indulgence are expanding the fastest, especially among younger consumers.

This list matters because it explains something the industry keeps treating as a contradiction: coffee is under pressure as a crop, but it’s expanding as a category.

The market isn’t just growing. It’s stretching into more occasions and reasons to buy. And once you stop thinking of coffee as a single drink, and start thinking of it as its multiple jobs, the chaos starts to reveal some order.

Meanwhile, the classic “café as third place” isn’t dead, but it’s flattening. It’s no longer the default use case everywhere.

Value isn’t “cheap” anymore

I also asked Darleen what “value” even means in coffee today. She said value no longer means “cheap” in this category. That ship sailed a while ago. It now means job efficiency.

If coffee does the job well – fast energy, a moment of pleasure, a reliable ritual – people accept higher prices. If it doesn’t, they downgrade quickly.

This may be a bit of a brutal wake-up call for brands that wax poetic about quality, because it’s no longer asking “is this good?”, because “good” is expected. It’s asking: does this do what I hired it to do, every time?

So what do people do when prices go up? When cost-of-living realities clash with wants, consumers don’t usually quit coffee first. They adjust around it. In fact, brand choice and customization are the first things to go. Frequency and core occasions are surprisingly sticky.

And when they do downgrade, it follows a pattern, according to Darleen. Afternoon or impulse coffee gets downgraded first. Morning coffee is the last thing to go, because it’s tied to identity and function, not just consumption. This is key because it may mean that while coffee isn’t recession-proof, that morning job function is about as close as it gets.

The job nobody is building for… yet

And that stickiness isn’t just about the “don’t talk to me before coffee” cliche. Darleen made a really important point about a role that is vital among consumers today, and is an under-served opportunity for coffee: mood and emotional regulation.

Coffee is still marketed like it’s primarily about taste, or primarily about energy. But consumers are using it to manage stress, anxiety, and transitions throughout the day. That transition detail is doing a lot of work. Coffee spreads itself across ‘wake up’, ‘start’, and ‘reset’ to ‘I need to feel normal again’ and ‘I need a moment that’s mine’.

Keeping in mind these need states helps explain consumer purchasing behavior and can allow brands to figure out how best to position their own products.

It also does a fair amount of heavy lifting when it comes to explaining why the category can tolerate price pain better than you’d expect.

Gen Z enters coffee through experience, not tradition

RTD is a good place to see this shift in action. If you want to know why this segment is exploding, you have to understand how younger consumers are entering the category. First of all, entry into the coffee market is starting at a younger age. Gen Z began at age 15 years, compared to Millennials who started when they were 18-20 years old.

They’re not entering through hot coffee and learning nuance later, Darleen said. They enter through cold, sweet, flavored, or functional formats, often RTDs. That one shift flips the category’s center of gravity.

For older coffee culture, “good coffee” often meant less interference: cues like origin, roast, craft, purity. For Gen Z and Gen Alpha, coffee starts as something closer to an experience: a treat, a vibe, a format that fits into life without instruction manuals.

And Darleen thinks “treat coffee” is evolving too. The next phase is less sugar, more sophistication: texture, bitterness balance, savory notes, and culinary crossover. It’ll be dessert-adjacent, not dessert-in-a-cup.

So yes, the category is getting sweeter and more playful. But the more interesting signal is that it’s also getting more culinary.

I caught up with Jake Berber, Co-founder and CEO of Prefer, at Gulfood and we talked about a number of things, including how coffee companies are looking at handling the current concerns of the industry. Watch here:

Pick a lane, and a channel

Once you accept coffee’s jobs are splitting, it follows that the market is splitting too, especially by channel.

In Darleen’s view, food service wins ritual, social, and status. CPG is increasingly winning fuel, consistency, and value. At-home can replace convenience, but never hospitality or atmosphere. And brands can get into trouble if they try to port one identity across every channel without respecting the job.

RTD is the clearest example of this. Darleen’s blunt take here is that RTD fails when it tries to be everything at once. If RTD had to own one job, it should fight for reliable, portable fuel with a hint of pleasure. That’s the lane it can win with repeatability. The moment it tries to also be ritual and wellness and premium, everything gets diluted.

Volatility is the default setting now

All of this is happening under one non-negotiable backdrop: volatility. Price volatility, supply volatility, and consumer confidence volatility.

Darleen’s view is that this forces coffee brands to design portfolios and messaging around flexibility, not perfection. That’s a meaningful difference. “Perfection” assumes stable inputs and stable consumers. “Flexibility” assumes constant change.

Her bets for the next 2 to 3 years reflect that:

Clear job-based portfolios across channels

Fewer SKUs, sharper positioning

Brands designed for volatility, not stability

And the strategy she thinks will fail – even if it looks sexy in the moment – is chasing trends without anchoring them to a real consumer job. Because in a workhorse category like coffee, novelty is not the point. Utility is.

So what? Actionable takeaways for coffee brands

Pick a job. Kill the “everything” trap.

One SKU = one primary job (fuel/ritual/treat/mood/values).

RTD: portable fuel + a hint of pleasure.

Build a job-based portfolio with fewer, sharper SKUs.

Ladder it (Fuel / Ritual / Treat).

Cut anything that doesn’t clearly win a job.

Design for job efficiency (value = payoff, not cheap).

Reliable results > poetic quality claims.

Treat coffee matures: dessert-adjacent (texture/bitterness/culinary), not syrup chaos.

Match job to channel (don’t copy-paste your identity).

Foodservice: ritual/social/status.

CPG/RTD: fuel/consistency/value.

At-home: convenience (not hospitality).

Gen Z on-ramp: cold/RTD/flavored → nuance later.

Assume volatility. Engineer for it.

Trade-down hits customization + brand first.

Protect mornings; compete smarter in afternoons.

Flex packs, tiers, sourcing, messaging.

📢 What do you think of today's Market Shake? 📢

Made with ❤️ by GourmetPro - your network of Food & Beverage experts, on demand.

👉 P.S.: GourmetPro is also on LinkedIn!