We were at SKS Japan last week, getting a first-hand glimpse into what’s happening in Japan’s food tech space. Here are the three key takeaways from the summit for me.

TL;DR

Still TL;DR? Check out our highlights video of SKS Japan 2025! 😉

Upcycling is back in the conversation

It’s been a while since upcycling has been top of mind for me. It exploded onto the scene a few years ago as companies looked for ways to repurpose side streams from food production to address heady issues like food waste and emissions from rotting food. And why not?

Project Drawdown, a leader in ranking climate solutions, says that preventing food waste and improving diets are among the top solutions to reduce greenhouse gas emissions.

More than a third of all food produced for human consumption is lost or wasted even before it can be consumed – across every step of the food supply chain. This means that all the resources that go into producing this food are wasted. So lowering food waste or loss can go a long way in reducing all the direct and indirect emissions linked to production through consumption.

According to them, improved diets means reducing ruminant meat consumption and replacing them with other protein-rich foods. This shift is a highly workable solution since it can be adopted incrementally through small behavioral changes that can result in significant reductions in GHG emissions globally.

In light of this, upcycling food side streams offers a viable alternative to not just reduce overall food waste but also to increase the productivity of food production as a whole. And a bunch of companies at SKS Japan were showcasing their ability to do this, playing up the “Mottainai” or “Let’s not waste” adage here.

I’m not going to get into the market size aspect of this, because you can google that if you’re so inclined. I’m far more interested in what’s changed and why it seems more likely to have an impact now.

Why this iteration of upcycling seems different

Well, for two main reasons.

Price and supply volatility now make upcycling a P&L tool, not just a planet story. Food production and yield have been fluctuating wildly, and food prices too. As I write this, bird flu has made a comeback in the US, just ahead of Thanksgiving and this will wreak havoc with prices. Add tariff and trade uncertainties and suddenly forecasting is nigh impossible.

B2B, not B2C. Upcycling is moving into ingredients and infrastructure where small swaps stabilize cost, texture, and nutrition, all behind the scenes.

Let’s look at the price aspect. Sidestreams of food production that are often discarded contain valuable ingredients that could help stabilize the supply chain – and costs – for a range of products.

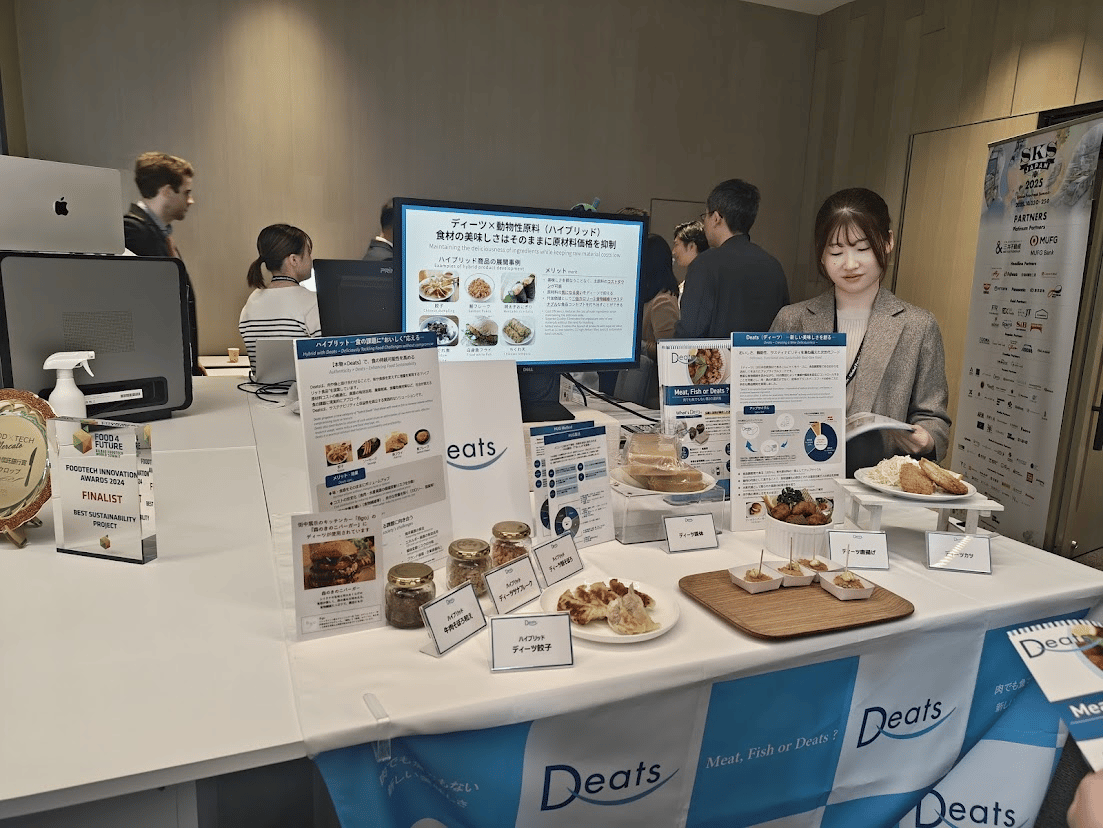

Take what Deats Food Planning Co is doing, for example. The company makes a sort of compound (Substance? Medium? I don’t know what to call it) from a combination of konjac powder and okara. The okara is the soy pulp by-product of tofu production and is pretty nutritious. Konjac is an excellent source of soluble fiber. The compound that Deats makes has a 70:30 ratio of konjac and okara and has no discernable flavor or taste, but also has a nice firm texture. So it can be used as a meat alternative all by itself OR can be added to meat-based foods to lower the quantity of meat needed, increasing the fiber content of the final product, while also keeping the costs intact for companies and the price intact for consumers. This is super important at a time when meat prices are through the roof. In fact, Deats’ compound is already being used by some major food manufacturers in Japan to optimize their meat costs.

The final products, which I got a chance to taste, were great. If they hadn’t told me, I wouldn’t have known it wasn’t all meat. If you can’t taste the swap, you just lowered costs and raised fiber content. And that’s a win.

Earlier this month, we saw ingredients to blend with meat in Europe. But what I liked about Deats is that their ingredient isn’t some insanely over-engineered isolate. It’s simple and made with well-known base ingredients, offering a more cost-effective and potentially clean-label solution. Oh, did I mention high fiber, the upcoming macronutrient trend, according to those in the know?

Two, upcycling moving from a B2C to a B2B offering just makes so much more sense than slapping on another claim to the pack to confuse consumers. It also takes away the burden on food companies to invest in proving their claims and makes the use of upcycled ingredients systemic, building it into the infrastructure of food manufacturing.

Many upcycled ingredients (not all) only need to be used in small quantities and that may not necessarily impact the sustainability credentials of the final product. In the US, for example, the Upcycled Certified Standard only requires a minimum of 10% of the upcycled ingredients by weight to get the certification. In fact, higher quantities may change the taste or look of the final product, which is not ideal. Despite this, many foods that carry the upcycled claim tend to be pricier than their regular counterparts. This can be linked to higher production costs for smaller companies that make or use these products.

In fact, some upcycled food companies have been shifting their B2C focus and creating separate entities that focus on creating ingredients that can be sold to other companies.

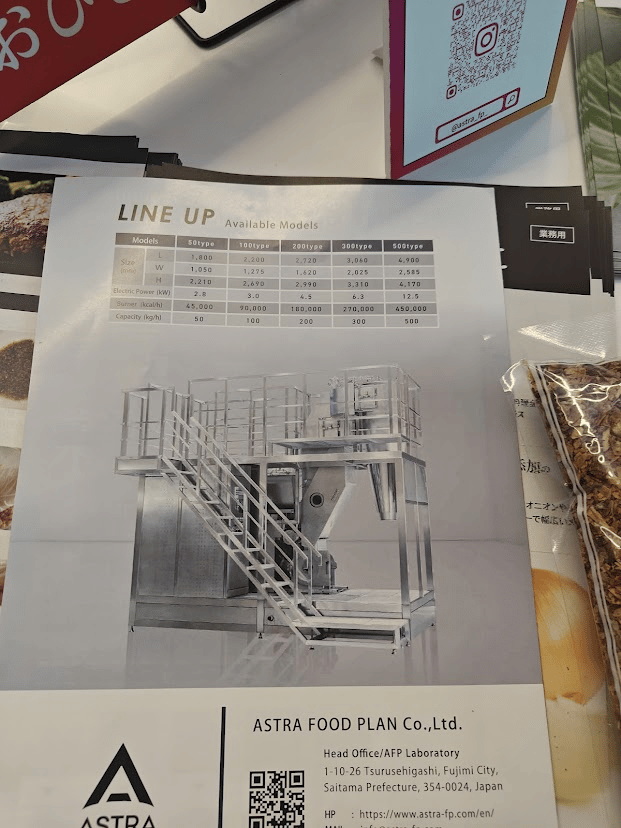

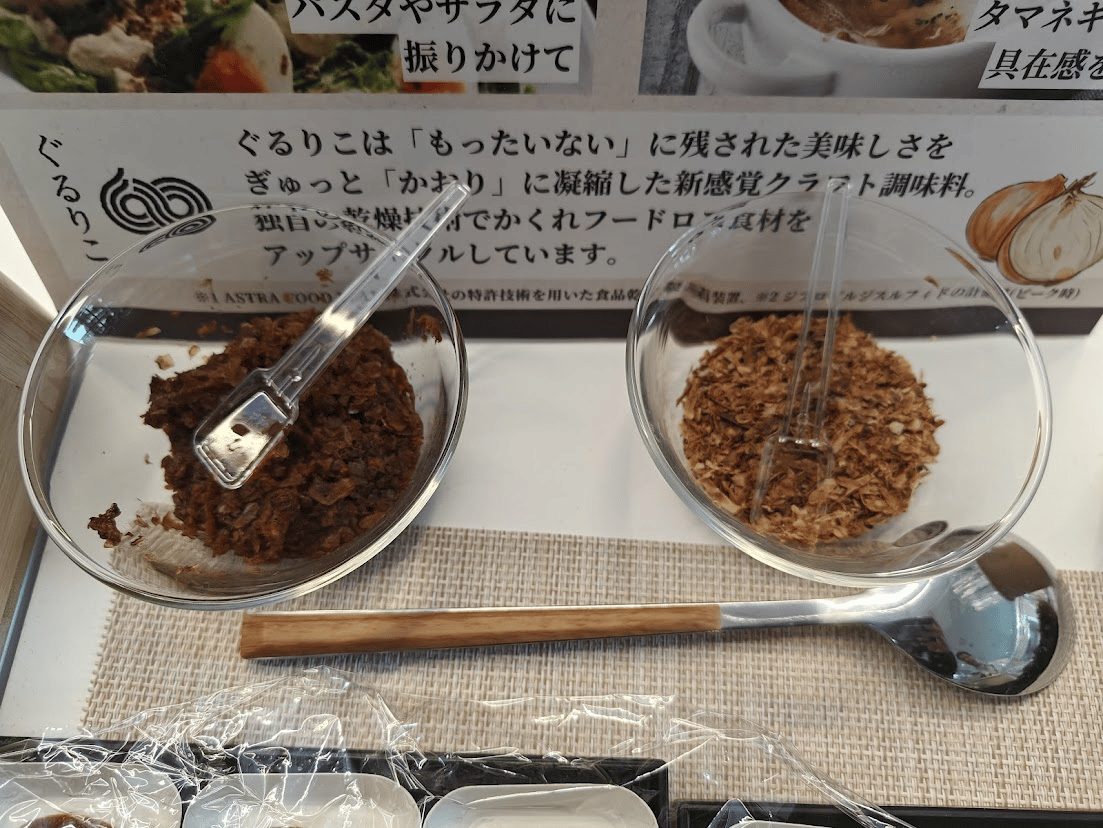

In Japan, Astra Food Plan has built a large dehydrating machine that can dry food scraps in just 5-10 seconds using superheated steam, significantly faster than the standard 12-24 hours for freeze-drying or air-drying. The use of superheated steam means that the final product is sterilized and safe to consume. It also doesn’t significantly impact color, flavor, or nutrition. And it’s not very expensive, with the energy costs at just JPY10-15 to dry 1kg.

One of the products that Astra was offering samples for was their dehydrated onion scraps – peels and leftovers after chopping onions in food service settings. These parts are full of flavor and don’t necessarily need to be thrown away (many people make stock with them). Astra’s dehydration process means that these onions can go back into the main cooking process. Adding a little bit of water can give you what are essentially fried and caramelized onions, saving a ton of time, effort, and money in restaurants. Astra’s plan is to sell the machine to food manufacturers to integrate into their operations and do this scrap revitalizing in-house, but since not everyone has the space to set this up, Astra will also be doing it themselves for others.

The company is even launching this product for at-home use in retail.

Quick roundup of other upcycling companies on the floor

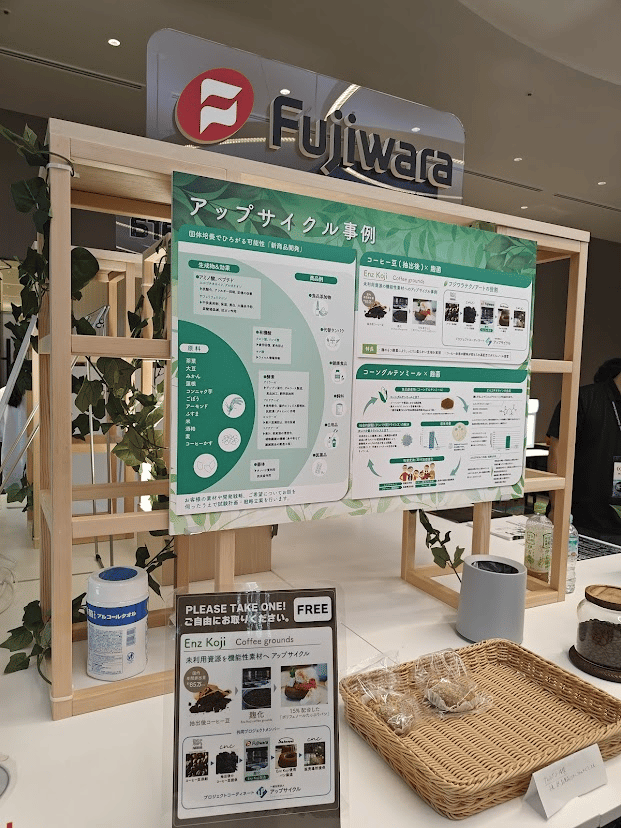

Fujiwara Techno-Art uses solid-state fermentation technology to produce koji from food by-products in a project called Enz Koji. Their first koji is made from used coffee grounds, sourced from Nestle Japan. Koji molds have long been used in Japan to make alcoholic drinks like sake and shochu as well as to ferment soybeans to make soy sauce and miso. This koji was used by a bakery to create a polyphenol-rich bread.

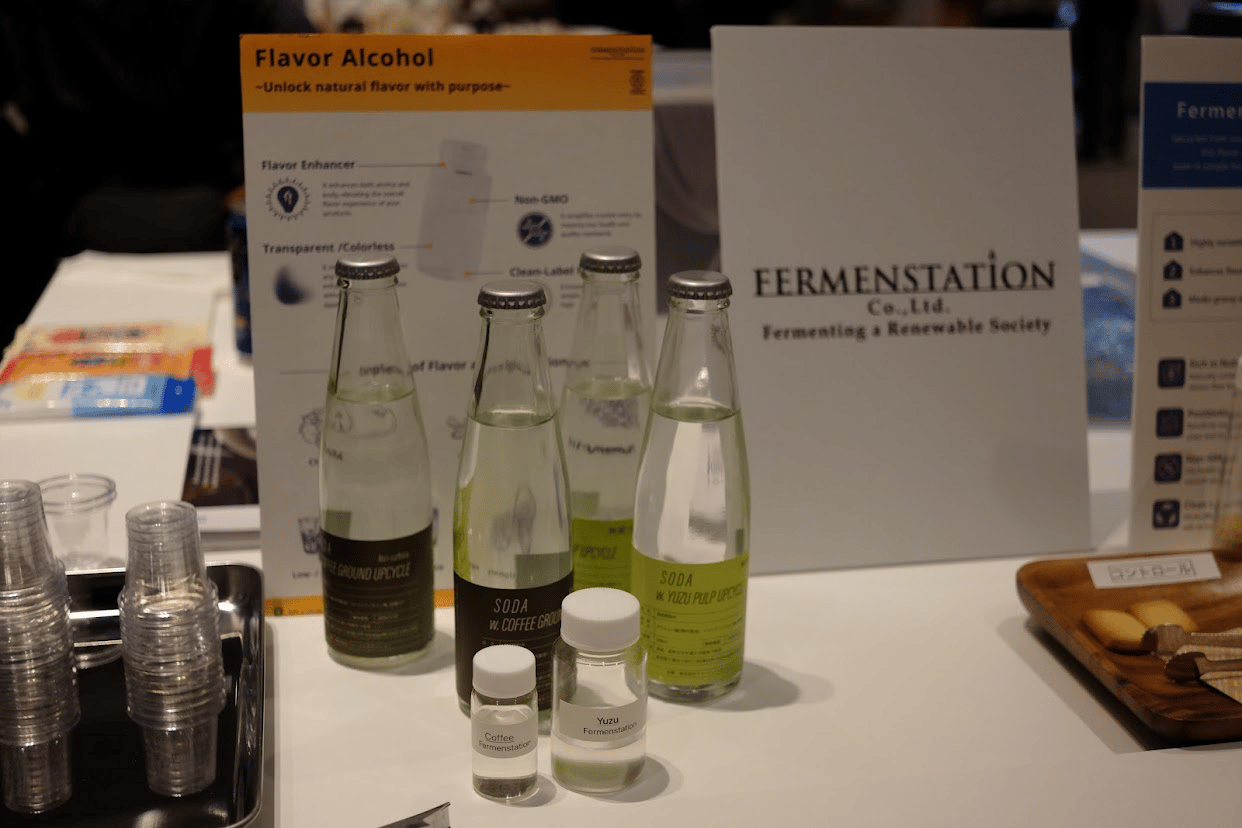

Fermenstation utilizes side streams from different production processes to create a range of ingredients through microbial fermentation. The company has already been working with the cosmetics industry and has a database of microbes and enzymes that can be used to make different functional ingredients. For the food industry, the company’s process can be used to make flavors from natural sources that might be in line with the clean-label needs of the industry and consumers. The company’s products have already been used by mainstream companies. Takara Shuzo’s Fermented Distilled Sour, launched in September 2024, uses an alcohol ingredient derived from discarded citrus peels.

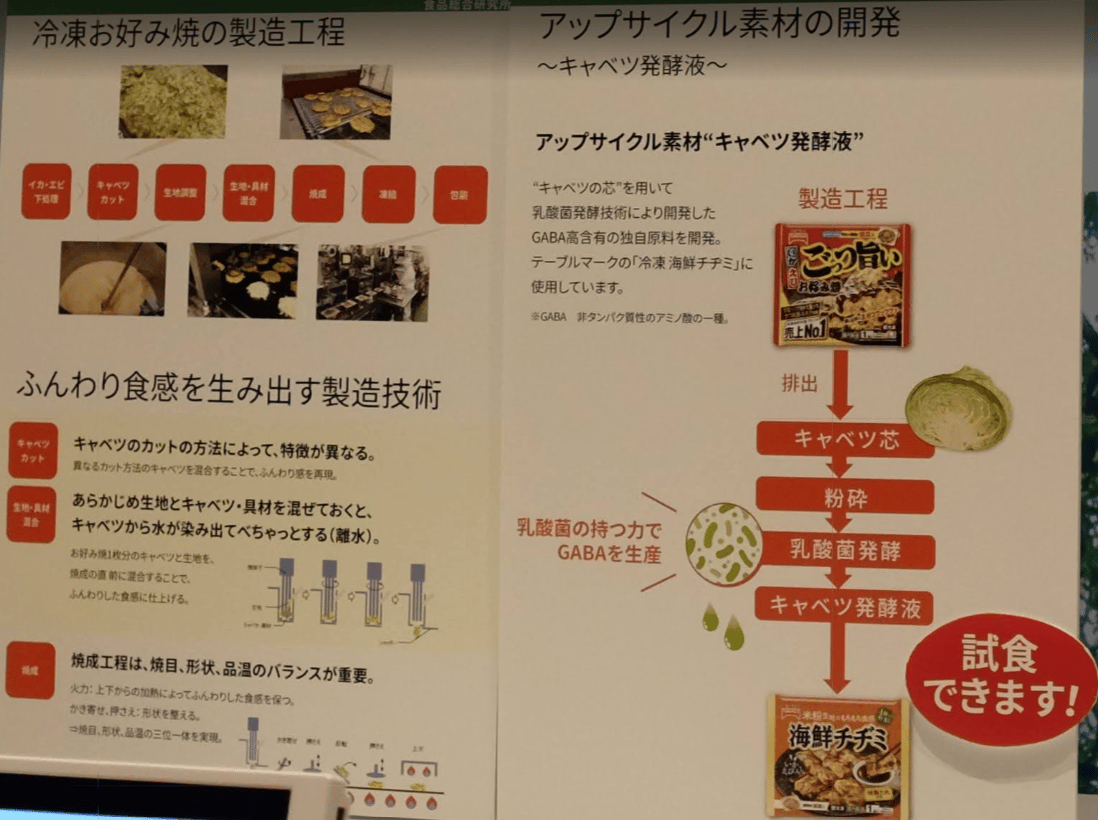

Japan Tobacco has developed an ingredient with a high GABA content by upcycling cabbage cores, a byproduct for the company from the production of its frozen TableMark okonomiyaki. The cores are crushed and lactic acid bacteria is used for fermentation, creating a GABA-rich ingredient that is then used in TableMark’s Seafood Chijimi. The brand doesn’t call it out as an upcycled ingredient, but incorporates it neatly into other products as a functional ingredient.

Image source: Amazon

It’s looking more and more like the way to go with upcycling is to use it to create functional ingredients rather than whole foods.

Everyday completeness (balanced nutrition, but fun)

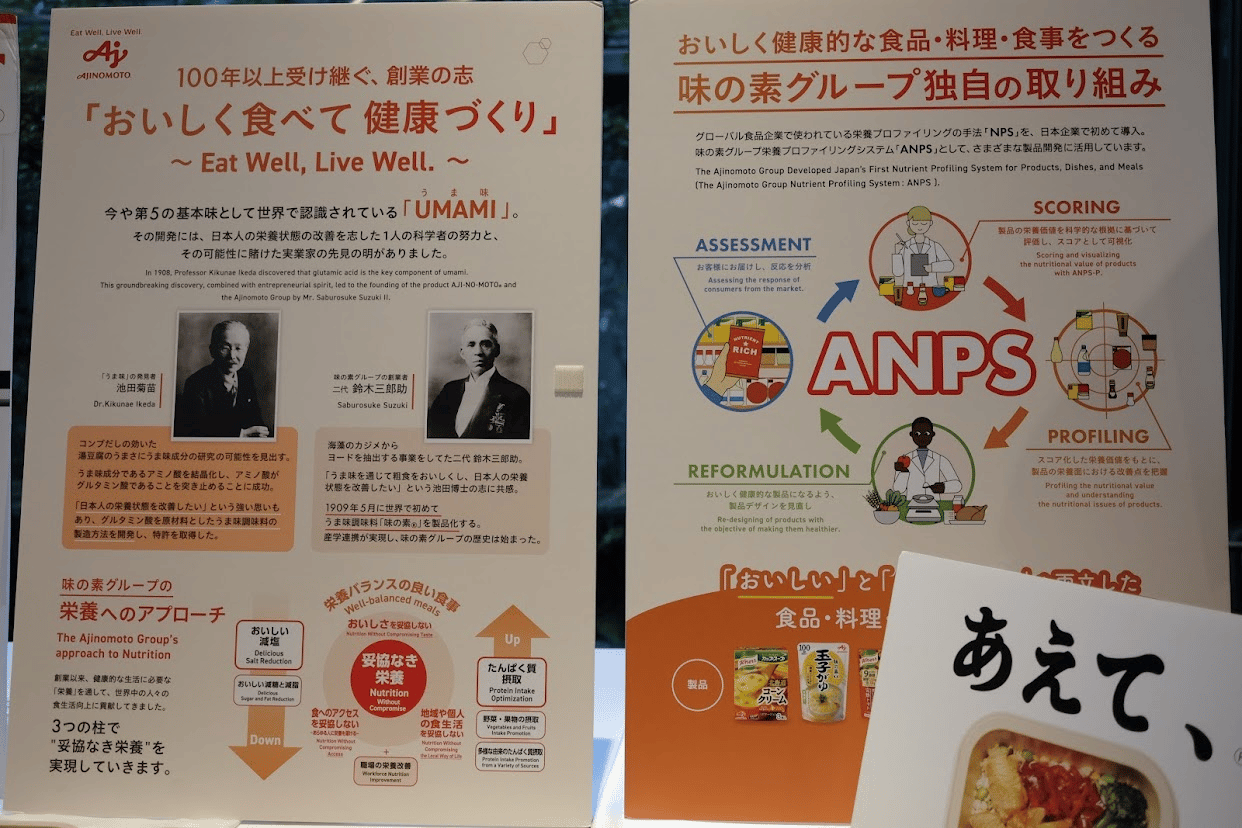

Health and wellness continues to be one of the most important food trends today, and things were no different at SKS Japan. In fact, one of the very first sessions I attended linked sustainability to H&W in a really interesting way.

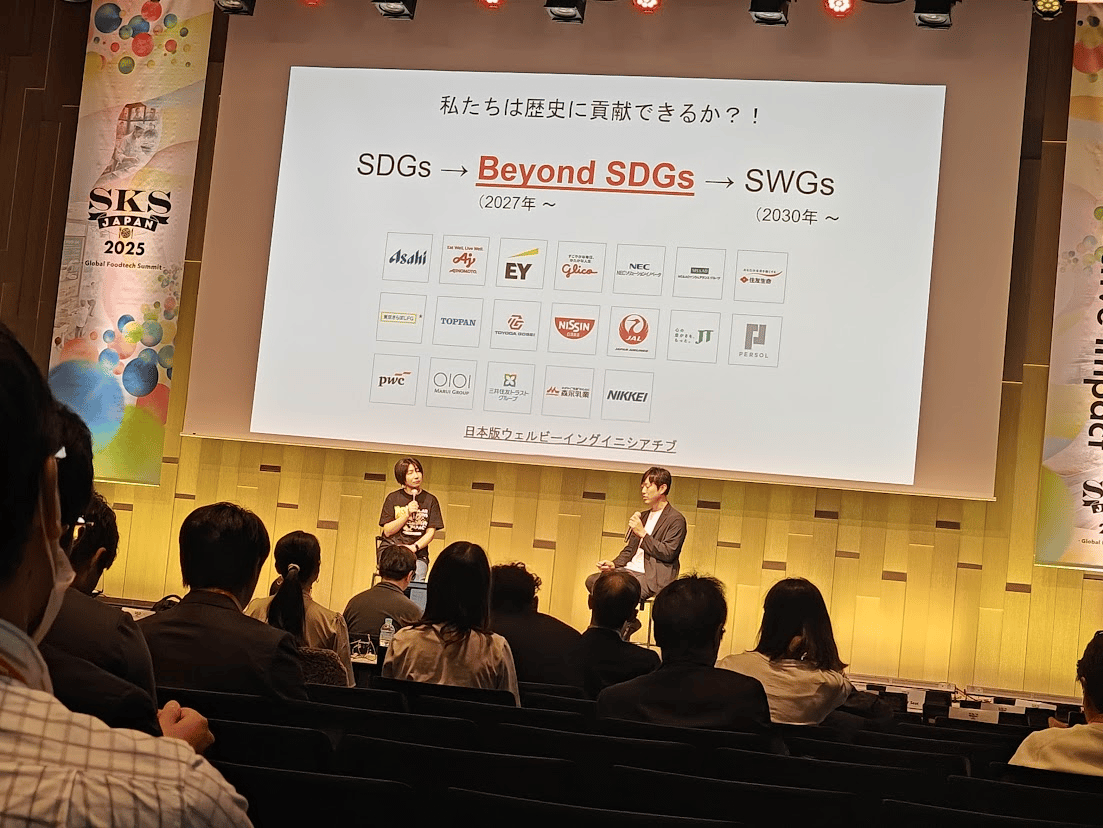

The talk looked at how sustainable development goals had evolved over the last few decades, moving from the Millennium Development Goals that sought to contain contagious disease and extreme poverty (among other things) to the ongoing Sustainable Development Goals (SDGs) that aimed to bring in a healthy planet and bring in greater equity.

The SGDs will end in 2030 and rumblings have already begun on what the next set of goals would look like. The speaker talked about how well being could be the next iteration of this, given the current state of the world. And food and nutrition play an important role in ensuring overall wellbeing.

Take gut health, one of the hottest trends right now. It’s pretty well accepted now that there is a strong connection between the gastrointestinal system and the central nervous system, and that gut health can influence brain functions and mood – and vice versa.

We’re also seeing the impacts of long-term consumption of ultraprocessed foods on health as well as the potentially disruptive nature of GLP-1 drugs on the food industry. While countries are still figuring out regulations linked to GLP-1 drugs, there’s expected to be a growing population of users in the coming decade. And brands are addressing their needs, with products that are high in protein, fiber, and nutrients, better quality ingredients, and limited in portion size. But these products tend to be really fancy, high-end products that may not appeal to everyone’s wallet.

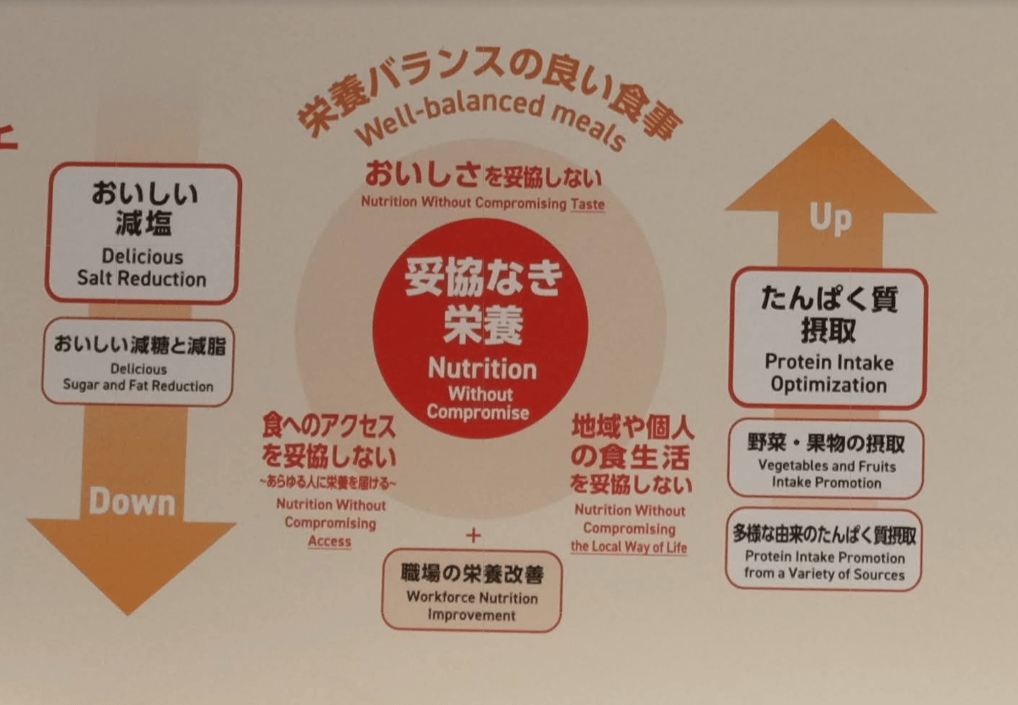

So I really liked what Japanese companies are trying to do: create everyday products that are familiar and decidedly better-for-you.

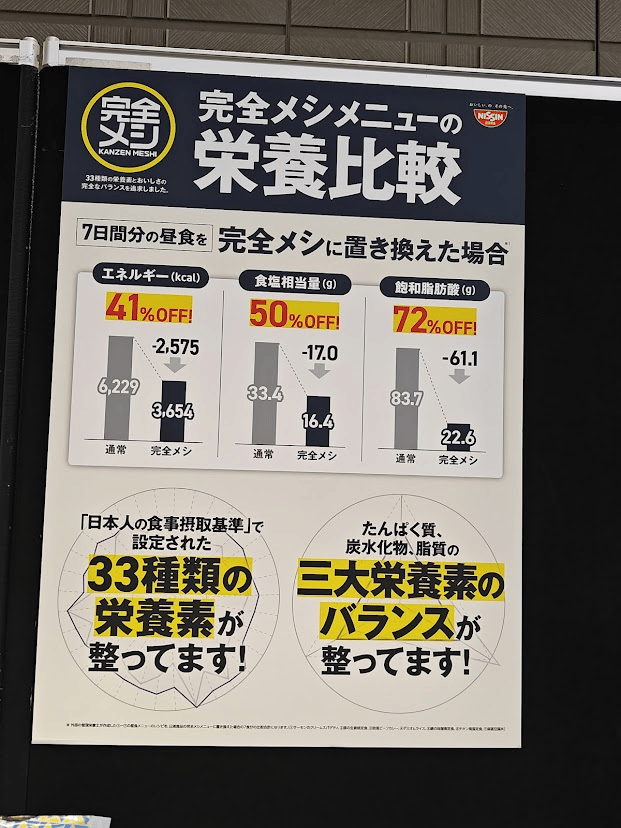

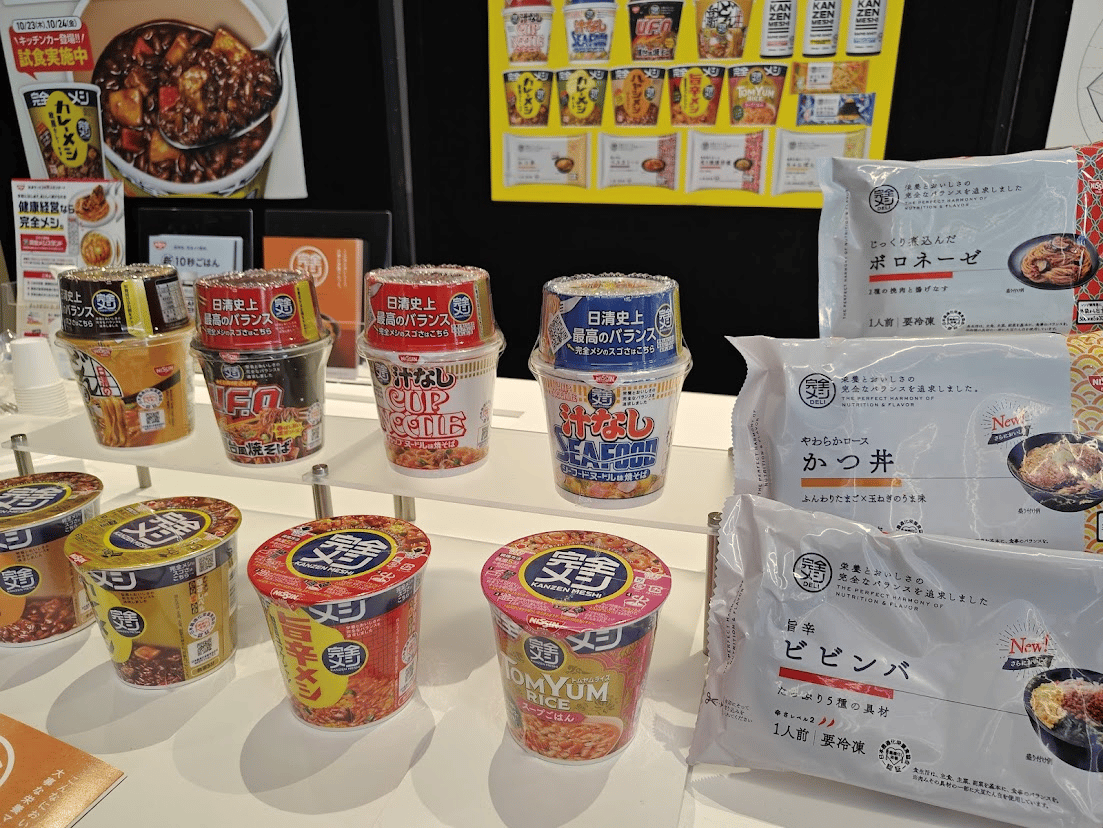

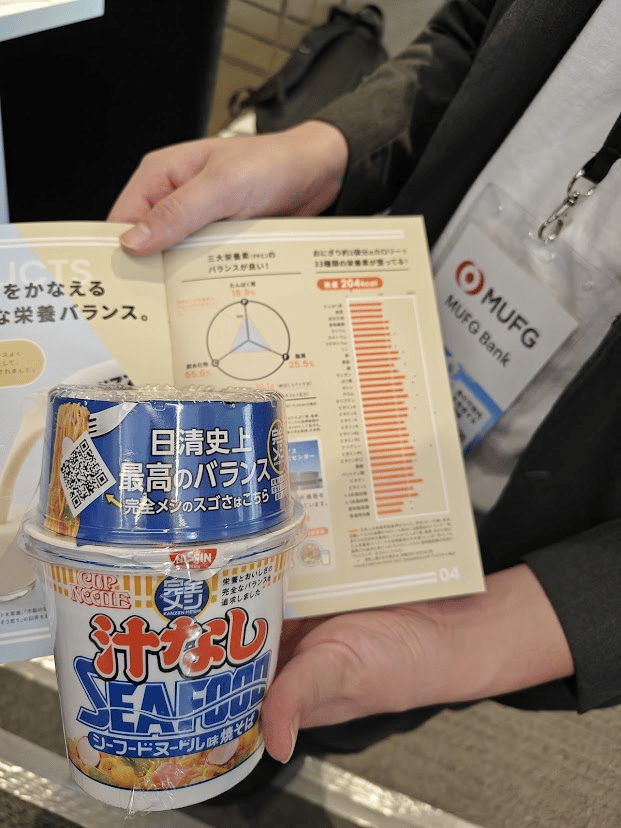

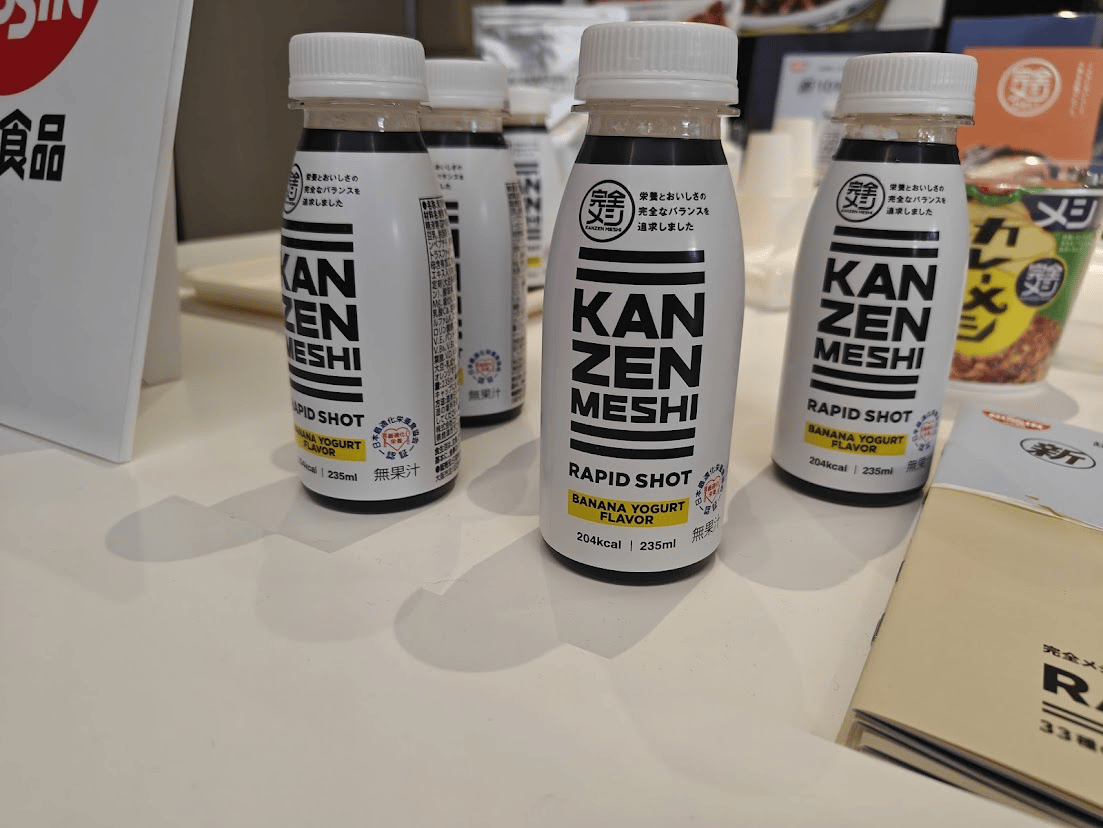

Take Nissin’s Kanzen Meshi (complete meals) range, for example. Spanning the company’s ubiquitous Cup Noodles, frozen ready meals, and even a drink, these meals offer reduced salt (50%), calories (41%), and saturated fats (72%), while also adding 33 vitamins and minerals, and a balanced intake of macronutrients. In fact, the company claims that one of these meals offers a third of the daily required nutritional value.

Each of these products carry the Kanzen Meshi mark and have been formulated based on the Ministry of Health, Labor and Welfare's “Dietary Reference Intakes for Japanese”.

Ajinomoto has products similar to Nissin, under the brand name Dare. These frozen bento boxes also claim to have a third of the daily recommended nutrition.

Base Food is also pushing the complete meal credo, one of the earlier brands to do so. A pack of the company’s bread for example contains 26 vitamins and minerals as well as 13g of protein and about 6g of dietary fiber.

Misovation is a company that makes craft miso soup in small batches with a focus on quality ingredients and balanced nutrition. The product is freeze-dried and contains the 31 nutrients recommended by the Japanese government.

For me, the primary takeaway was that Japan seems to have figured out a way to incorporate nutritional density into tasty and well-liked foods rather than forge ahead with the belief that healthy food couldn’t possibly taste good.

There are plenty of lessons to be learned here from the focus on balance and wellbeing. Japanese food tends to be healthy to begin with, but the confluence of busy lifestyles, an increasing number of single-member households (expected to go up from 34% in 2023 to over 44% by 2050), and an aging population means that people may be more inclined to go for convenience over health. This complete meal angle may be a good trade-off.

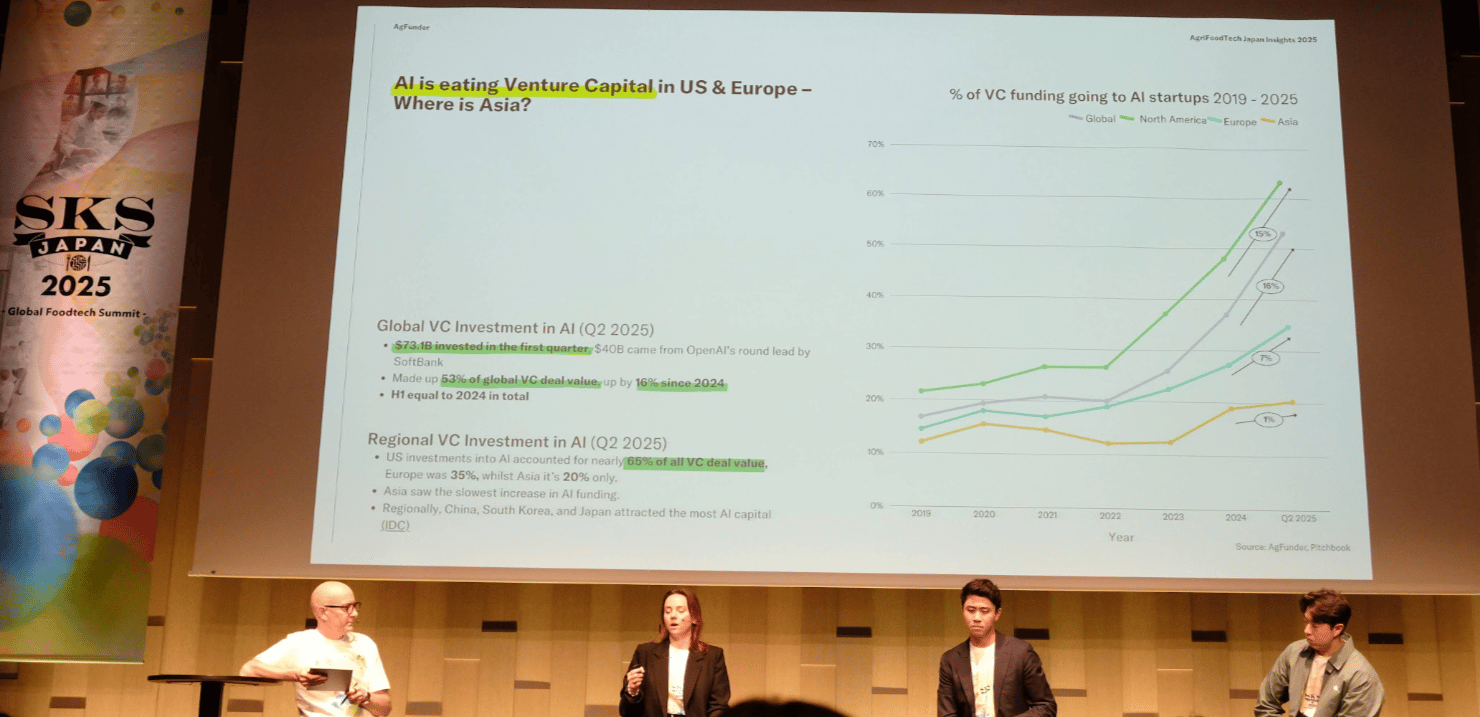

Follow the VC money: Agtech losing to AI

Venture capital investments in agrifoodtech are drying up, according to a panel discussion on the global outlook for future foods. Across regions, there were fewer deals and smaller deal sizes last year.

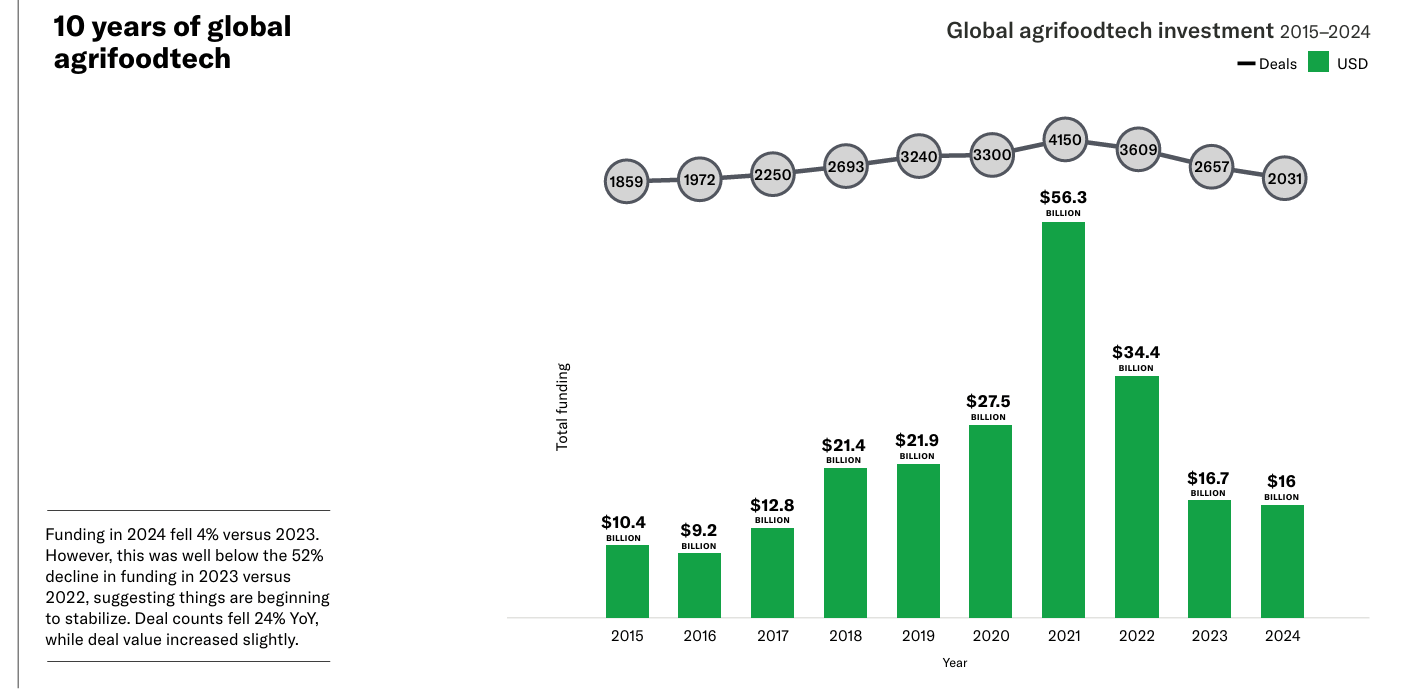

According to AgFunder (the Managing Editor was part of the panel), global agrifoodtech investments, which had more than doubled between 2020 and 2021 to US$56.3 billion, have significantly dropped since 2021. In 2024, investments were at US$16 billion from 2,031 deals (versus 4,150 deals in 2021).

The sectors that had shown the most promise way back in 2021 – like alt protein and vertical farming – have struggled to raise future rounds of funding and there’s not a lot of interest in them at the moment.

Data from the panel highlighted how global VC investments now were largely being commandeered by AI, especially in the US, where investments into AI accounted for around 65% of all VC deal value during Q2 2025 alone. Europe accounted for 35% of deal value, while Asia was at 20%.

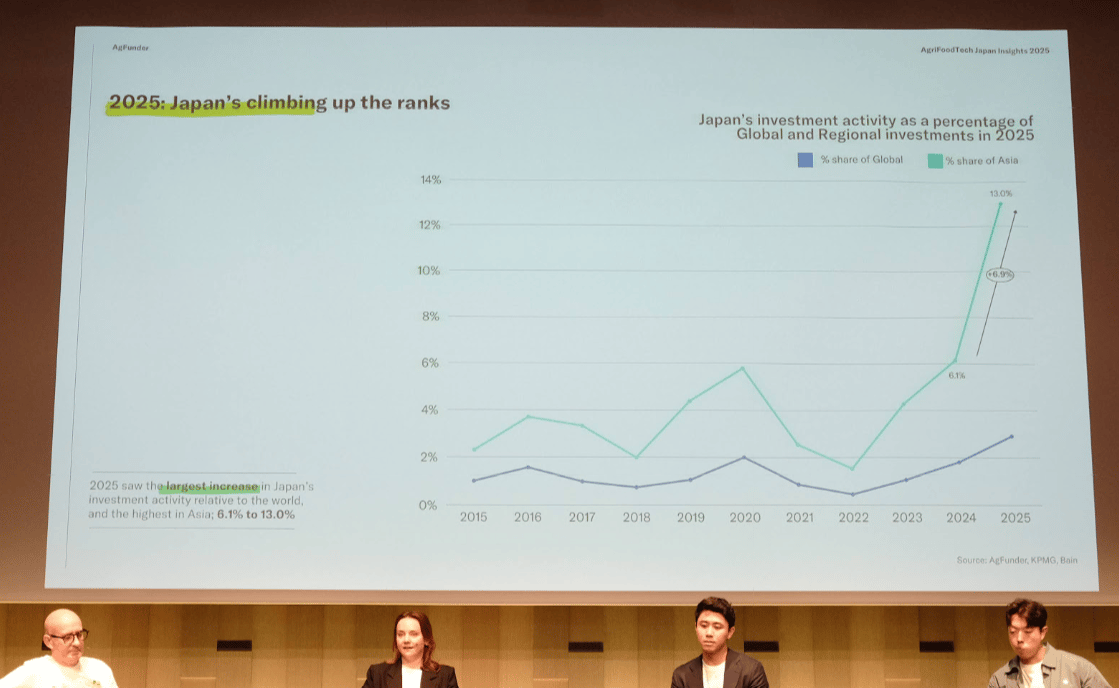

Amidst the slowdown across regions, there was still some cautious optimism in terms of where VC funding was heading. Japan has seen growth in this investment, especially in deep tech, though agrifoodtech was seen as a niche in the space. In fact, in 2025, Japan’s investment activity saw the highest increase in Asia.

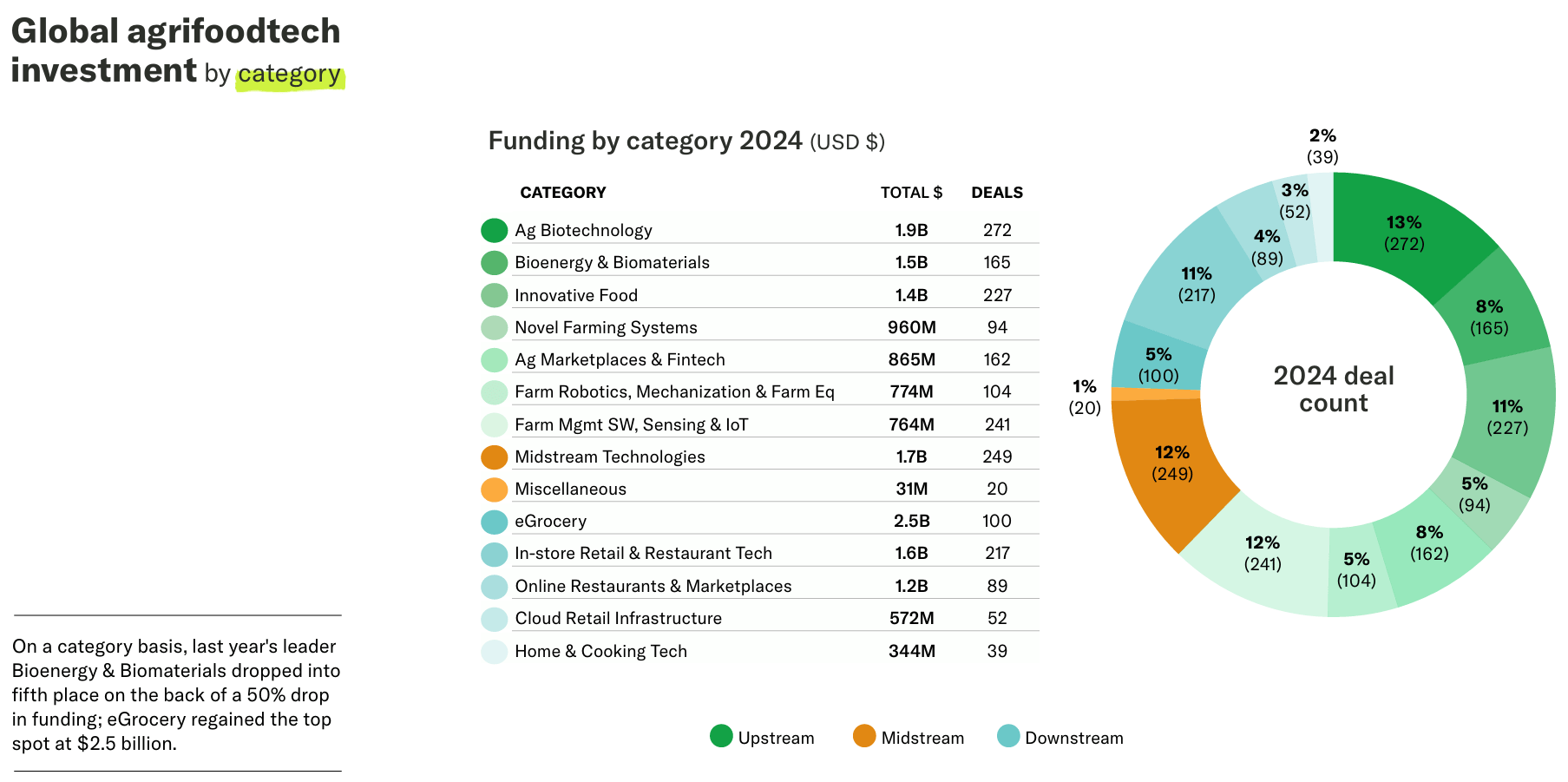

And this pattern does make sense given the kinds of products we saw at the event. A lot of them were deep tech, and there were conversations happening all around to see how AI and LLMs fit into agrifoodtech. People I spoke to were quite gung-ho about the use of biotechnology in agriculture and food, and how it might help with food security and production. And this bears out in AgFunder’s data as well, with the ag biotech space seeing the largest number of deals and the highest value globally in 2024.

Japan’s food tech ecosystem may be smaller than the West’s, but it is evolving differently. The money is following science, not slogans, with deep tech that fixes real supply and nutrition problems. And as such, the future of food tech might not be moonshots, it’ll be the margin-makers.

📢 What do you think of today's Market Shake? 📢

Made with ❤️ by GourmetPro - your network of Food & Beverage experts, on demand.

💖 And if you think someone you know might be interested in this edition of Market Shake, feel free to simply forward this email or click the button below. 💖

👉 P.S.: GourmetPro is also on LinkedIn!